Direct Genomics' New Clinical Sequencer Revives a Forgotten DNA Technology

By Aaron Krol

October 29, 2015 | BGI ― formerly the Beijing Genomics Institute, China’s contribution to the Human Genome Project, and now a hybrid state agency and private corporation ― is one of the world’s largest scientific research and industrial powers. From its headquarters in Shenzhen and outposts across Asia, Europe and the United States, BGI performs population-scale genomics studies, runs the world’s largest on-demand DNA sequencing service, and sells a small but growing suite of commercial products. Last week, BGI revealed the first sequencing instrument to be developed and produced in China, the BGISEQ-500, launched exclusively to Chinese markets.

Like other recent Chinese accomplishments in high-tech fields, the sequencer is as much a point of national pride as it is a commercial venture. “Shenzhen has transformed itself from labor-intensive industry to high tech,” says He Jiankui, a specialist in genomics and biochemistry who teaches at the city’s South University of Science and Technology of China. “The government has ambitions. They’re trying to switch from ‘Made in China’ to ‘Invented in China.’”

The BIGSEQ-500, in fact, is based on American technology, which BGI bought up with the California-based Complete Genomics in 2013. But reimagining that technology, formerly housed in refrigerator-sized sequencers and manned by a small squadron of lab techs, to work in an easy-to-use benchtop instrument was a major feat of engineering. With the enormous demand for DNA sequencing in Chinese hospitals, it could be a commercial coup as well.

It’s a feat that He would like to replicate. In addition to running his university lab, He is the founder of Direct Genomics, a small company that aims to be the second to bring a Chinese-made sequencer to market. Direct Genomics already has a prototype instrument, called the GenoCare Analyzer, up and running, and this week the company announced a partnership with three hospitals in Shenzhen and Guangzhou to pilot a limited set of clinical tests.

“We’re a new generation of entrepreneurs,” He tells Bio-IT World. “We’ve had great discussions with the Chinese FDA, and they’re very welcoming for us to apply for clearance. They really hope our Chinese brand could be used in hospitals.”

Like the BGISEQ-500, GenoCare is at heart built on an American sequencing company’s technology, given a significant overhaul in Shenzhen. But He didn’t have to buy a big player like Complete Genomics to get his hands on the intellectual property. Direct Genomics licenses its IP at a bargain from Caltech, using a sequencing method first brought to market by Helicos Biosciences of Cambridge, Massachusetts. The technology has been out of production for five years, and Helicos itself went bankrupt in 2012.

Geneticists never took to Helicos ― the company sold only around a dozen sequencers in the brief period, from 2008 to 2010, when its HeliScope instruments were on the market. But He thinks a new generation of customers might see the technology differently.

Reviving Helicos

The story of Helicos is an interesting wrinkle in the history of DNA sequencing. The company was founded in 2004 by Stephen Quake, then a professor at Caltech, who had come up with a way to sequence single molecules of DNA without first copying them through polymerase chain reaction. No previous technology had attempted this; in theory, single-molecule sequencing could correct for PCR biases, work with smaller volumes of sample DNA, and offer unprecedented accuracy in any experiment that involved counting DNA molecules.

In practice, Helicos was never a frontrunner in the field. By the time the HeliScope reached customers, Illumina of San Diego was producing DNA data faster, more cheaply, and with higher accuracy. But Helicos technology did manage to sequence a whole human genome (Quake’s), and in its time, the HeliScope could run more sequencing reactions in parallel than any other instrument available.

“I was very disappointed at the demise of Helicos,” says Bill Efcavitch, the company’s former Chief Technology Officer, and now Chief Scientific Officer of a DNA synthesis business called Molecular Assemblies. “I don’t think the Helicos technology was finished evolving.”

Helicos did hang around just long enough for a particular post-doctoral fellow in Quake’s lab to get acquainted with the technology. He Jiankui, who had just gotten his PhD at Rice University, joined Quake in his new lab at Stanford for one year in 2011. It was a brief, fortuitous chance for He to learn the ins and outs of single-molecule sequencing ― as well as work with a scientist with a long track record of spinning off companies from his university research.

That was exactly what He planned to do after returning to China, although it would take him a couple of years to form a clear picture of his own company’s purpose. From 2012 to 2014, as He mulled over business ideas ― and most of the remaining HeliScopes were shipped to Woburn, Mass., for a tiny sequencing-as-a-service business ― the market for genomics went through a radical change. Hospital labs dramatically ramped up genetic tests for cancer mutations and rare hereditary diseases. In the U.S., Illumina became the first company cleared by the FDA to sell sequencers explicitly for clinical use. BGI would soon follow in China, where an especially large market appeared for non-invasive prenatal testing (NIPT), a method of sequencing blood samples from pregnant mothers to detect serious conditions like Down syndrome in their developing fetuses.

Finally, in 2014, He came up with his pitch: to revive the old Helicos technology, but with an extremely narrow form of sequencing in mind. Direct Genomics would build an instrument meant only for the burgeoning clinical market, devoted to highly targeted sequencing for diagnostic tests. He contacted Quake and Efcavitch, along with his former advisor at Rice University, Michael Deem, to see if they would be interested in serving as scientific advisors to his company.

“The original Helicos was doing whole genome sequencing,” He says. “But now the major market for sequencing is not in research. It’s in clinical analysis, where whole genome sequencing is not popular.”

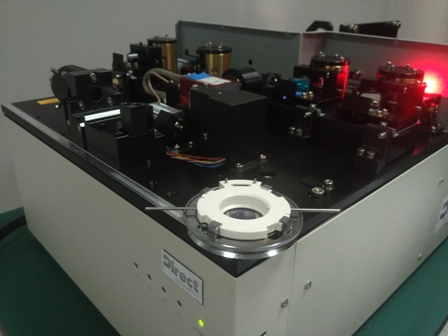

A prototype GenoCare Analyzer with its hood removed. Image credit: Direct Genomics

Quake and Efcavitch were eager to sign on, in part because He’s vision takes advantage of an aspect of Helicos sequencing that never caught fire in a research setting. Other sequencing methods require DNA samples to go through rounds of PCR, or chemical tweaks to the native DNA molecules ― a small burden for researchers, but a big deal for busy clinicians with limited lab training.

The Helicos method, however, reads raw, unmodified DNA. Sample preparation from a blood or tissue sample is just two steps: isolating the DNA, and shearing it into fragments. “The sample prep for this kind of single-molecule sequencing is by far the most straightforward of any technology out there,” says Efcavitch. “And that’s a key point for a clinical setting.”

At Direct Genomics, He has also worked out a way to bypass target enrichment ― an extra sample preparation step for targeted tests, to make sure only DNA from the gene regions you’re interested in testing gets into the sequencer. Helicos sequencing worked by anchoring sample DNA in place on a flow cell, with small single-stranded DNA fragments as the “anchors.” On the GenoCare instruments, He has simply redesigned the flow cells so that those anchors will only bind with specific DNA sequences, tailored to the needs of each test.

“For all other next-generation sequencing, the target enrichment and sequencing are separate things,” says He. “What we do is combine the two steps together. In one flow cell we do the targeted capture and the sequencing.”

That means the flow cells aren’t multi-purpose like in a research-grade sequencer, but for an instrument designed for diagnostics, that doesn’t matter. Direct Genomics will release a series of different flow cells for different tests, and clinicians will use exactly the same sample preparation steps for each one.

Reengineering

In the years since Helicos closed its doors, there have been several agnostic advances in technology that have let Direct Genomics build a more efficient machine than the old HeliScope. The GenoCare Analyzer has new optics, cameras and flow cells; it’s a fraction the size of a HeliScope (about as large as a file cabinet) and much less expensive. While GenoCare’s total data output is lower than a HeliScope, its runs are also much faster, sequencing almost ten times as many bases of DNA per hour.

Still, for almost any research purpose, GenoCare would be a truly poor choice of sequencer. Its throughput, about 10 gigabases of DNA per 15-hour run, lags far behind the competition. Worse, GenoCare reads DNA in fragments of 35 bases or less, a small fraction of the read length of other sequencers. For any geneticist trying to stitch together reads to create a larger picture of the genome, these tiny fragments are not only computationally demanding, but also completely obscure important deletions and rearrangements in the genetic code.

GenoCare also suffers from a particular weakness that Helicos never overcame. Its chemistry, in which fluorescently-labeled bases are added to the sample DNA one at a time and photographed, is vulnerable to “dark bases,” where the fluorescent label is lost before it can be imaged. That leads to a high rate of false deletions in the sequence, which are hard to correct with a single-molecule technology that doesn’t have the high redundancy of other methods.

To some extent, Direct Genomics is working to fix these problems; He says that the read lengths, for instance, can get as high as 200 bases if needed. But for the most part, the company is just dodging GenoCare’s faults as a sequencer, by picking clinical targets where its flaws are irrelevant.

Take cancer mutations, one of the first indications Direct Genomics is piloting with its hospital partners. A large body of mutations are known to occur frequently in cancer cases, several of which indicate a good chance that a particular therapy could be effective in attacking the tumor. These cancer signatures can often be identified by single-base differences from the wildtype genome, as in the case of a panel of eight mutations Direct Genomics has tested its technology on.

“For some cancer genes, we know the target, we know where a mutation could happen, and we design a probe that’s very close to that hot spot mutation,” says He. “Then we can sequence a very short fragment to get an answer.”

“For some cancer genes, we know the target, we know where a mutation could happen, and we design a probe that’s very close to that hot spot mutation,” says He. “Then we can sequence a very short fragment to get an answer.”

Designing panels that look for single-base substitutions, instead of deletions or insertions, also lets Direct Genomics play to its strengths. “Our substitution error rate is very low, half a percent,” He says. “So it meets our clinical use requirements.”

This isn’t an infinitely flexible approach. It will never offer users a chance to test for large structural rearrangements in cancer, for instance. But considered as a diagnostic device, GenoCare is hugely versatile, covering indications in cancer, infectious disease, and hereditary conditions. Direct Genomics has already made panels for NIPT and to test for antiviral resistance in Hepatitis B, which affects well over 100 million people in China.

“An important strategy for Direct Genomics is the correct choice of applications here,” says Michael Deem, who has been traveling in China with He to help assess the market. “There’s something like 1,400 tier-one hospitals in China that are focused on cancer, so it’s a big market for cancer diagnostics and monitoring… The easy sample preparation is really addressing the cost, labor, and technical concerns to make this feasible in the clinic.”

The Clinic or Bust

GenoCare isn’t the first sequencer built for clinical tests, but it’s the first to so thoroughly write off anything else you might do with genomic data.

If everything goes as planned, Direct Genomics customers will never see much of the underlying DNA data they’re generating: the company will write software for each test to analyze the sequencing signals and report back variants. “It will all be on the machine directly,” says Deem. “The flow cell will be designed for a panel, and then the software would be analyzing the results from the cell to get the answer for your panel test.”

In this sense, a GenoCare panel could feel less like a sequencing run and more like a DNA microarray, a multiplexed test for a specific set of variants. Microarrays, however, involve a great deal of hands-on work in the lab, treating your sample to isolate and label the DNA of interest. The GenoCare gives the same results just by putting raw, unselected DNA in the flow cell.

Direct Genomics plans to work with its first hospital partners to put together a core set of tests for launch, and to make sure its performance is consistent on real clinical samples. (Internally, the company has mostly tested its technology on synthesized DNA, although it has performed NIPT from real blood samples.) These tests on live samples will be the first demonstration of some of He’s most optimistic claims about his technology ― like that GenoCare will be able to work with very small quantities of DNA, or with the highly fragmented and degraded DNA found in cancer biopsies.

Fitting GenoCare into the hospital workflow, once the company scales up from its prototype instruments, will be an even greater challenge. “The idea,” He says, “is if a patient comes into the hospital and gives blood in the morning, we could load the DNA into the sequencer in the early afternoon, and then the patient comes back the next day and gets a result.”

“That’s the goal for any diagnostic tool,” Efcavitch adds. “Physicians really don’t want to be burdened with sequencing information. They want a direct statement: here’s a mutation.”

It’s not often that a fast-paced field like genomics dips into technology that was once written off as obsolete. But in a strange way, Helicos ― too slow, too flawed and too expensive to compete seven years ago ― might have been a little ahead of its time. While no one had much use in 2008 for sequencing directly from raw DNA, large-scale NIPT and cancer testing is a new niche that has yet to settle on a single technology.

“Steve Quake and I periodically reminisce about what Helicos could have or should have been,” says Efcavitch. “I’m very optimistic, and I’m pleased to see the technology coming back. It’s a brand new market.”

Correction 10/30/15: This article originally misspelled He Jiankui's given name as Jiankiu. The author regrets the error.