Opportunity Identification - Zeroing In On The Most Promising Targets

Contributed Commentary by An Nguyen

October 17, 2018 | For life sciences and biotech companies, developing a strategy for bringing a product to market can be a very difficult task. Technology can provide great advantage: it can be applied to many different problems. But it also brings great challenge: it can be applied to many different problems, and that decision could lead to a difference of millions of dollars. Where should you start?

When considering opportunities for a broadly applicable therapeutic, an innovative new screening technology, or a new drug delivery approach, companies often start with the industry experience, gut feeling and intuition of their senior teams, and those are good starting points. Another component, however, is critical to finding out where the most interesting opportunities lie: evaluation based on comprehensive, up-to-date datasets covering multiple dimensions: preclinical, clinical, regulatory and commercial.

Many teams try to achieve this by subscribing to a database that enables them to track high-level details such as company, asset, mechanism of action, and clinical trials. These are all good data to have, but do not necessarily help you decide if one opportunity is better than another. These generic databases lack the granularity and personalization needed to narrow down thousands of candidates to a strong Top 10. They might get you to a Top 100, but only with weeks or months of rigorous evaluation by your internal team.

Another option is creating your own in-house, custom database. This works well for life sciences companies with an abundance of engineers, analysts, and data scientists—but that is rare. The task is time consuming and expensive, and requires a lot of hard-to-find, in-house analytics talent.

Fortunately, there are now services that address the need for opportunity identification, providing an affordable way to not only find opportunities but narrow them down to a manageable number of top hits.

These services include access to comprehensive datasets that typically source data on diseases, proteins, pathways, clinical trials, scientific articles, and grants—among others—and can build a tailored database for each client project. The services typically couple a custom database with the insight of experienced and unbiased professionals to curate that data, helping clients quickly get to that Top 10.

Opportunity identification - common client queries

Services used by life sciences and biotech companies need to support diverse strategic questions tailored to each customer’s needs.

Here are some examples of common client queries:

- Broad opportunity landscape queries, such as, “Our asset is a broad-acting anti-inflammatory. What rare diseases should we target?”

- Technology deployment queries, such as, “Our platform can extend the half-life of biologics. What indication/biologic combinations should we target?”

- Mechanism of action queries, such as, “We have an immune-checkpoint inhibitor. What other cancers should we target?”

- Commercial queries, such as, “We have developed a new diagnostic assay. Which researchers use a similar product and would therefore be key target customers?”

- Investment decision queries, such as, “How big of an opportunity is this? Should I invest $100 or $500 million?”

A reputable technology partner should be able to narrow down a broad list of potential opportunities, which might contain 100s or even 1000s of hits, to a manageable list of the Top 10 in days or a few weeks, rather than months.

How to find the right partner for opportunity identification

When tackling opportunity identification, life science and biotech companies need to look at services and technology platforms that can leverage data collection to come up with a targeted list of opportunities and bring on a senior team to develop relationships with them before and after the automated data crunching. The key to obtaining actionable insights is identifying the right search parameters for each query based on a deep understanding of the customer’s needs. After a database returns the results, service providers should not simply hand the customer a list, but work closely with the customer’s team to translate the results into a strategy and to socialize the new opportunities with leadership.

Opportunity identification is a notoriously difficult problem and neither a purely data-driven approach nor one relying entirely on human experience delivers the best results. Life sciences and biotech companies should look for services that combine both to deliver truly actionable results.

Key attributes to look for in a partner include:

- Data-driven

- What data and tools do they use? The best will be able to develop curated datasets by pulling together disparate data for you to create a holistic view focused on your needs. For some this might be an emphasis on preclinical data, proteins and disease etiology, while for others this might be an emphasis on patient unmet need, clinical trials, and regulatory data.

- How are they thinking through criteria for what good looks like? Data is just the first step. Critical to a project is the methodology they define to decide if an opportunity has potential or not.

- Customer-centric

- Do they understand your company and your specific needs?

- Are they tailoring their offering to meet those needs and get you to your next milestone or offering you something off-the-shelf?

- Agile and iterative

- How is the engagement structured? Intermediate milestones are important to make sure progress is being made and everyone is aligned. It also makes sure you’re only investing resources in opportunities that look promising.

- Is there flexibility if the data tells you to head a different direction? Often initial research suggests the initial question wasn’t the right one to ask, and the team will need to adjust the scope and direction of the project. The more technically driven partners are best positioned to adapt quickly.

- Delivers results that are usable and actionable

- What does the deliverable look like? Excel and PowerPoint are often not enough to help you manipulate and socialize the data. Airtable is an example of a great tool that makes complex data easily shareable.

- What does support after handoff look like? Rarely is the project just handed off. Is there support for additional analysis, answering follow up questions, and walking other colleagues through project findings?

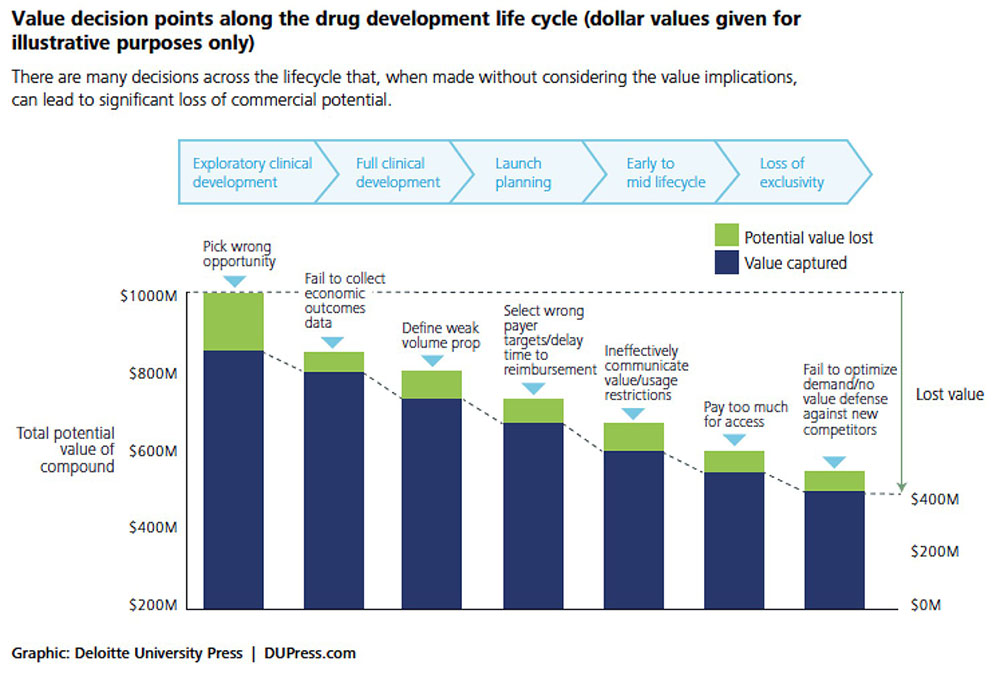

Making the wrong call on opportunity identification has lasting implications that can stretch on for decades, cascading and compounding as time goes on. Of all the steps a life sciences company can take in its go-to-market strategy, this is the most crucial one to get right.

Dr. Nguyen is the Head of Strategy at H1. With an extensive background in engineering, medicine and finance, she has worked with a diverse set of portfolio of healthcare and life science companies for more than a decade to expand their strategic planning capabilities with software and data. She initially developed this business intelligence platform during her post doc at the Jacobs Technion-Cornell Institute at Cornell Tech. She can be reached at an.nguyen@h1insights.com.