Challenges Faced by Hospital Services Industry

The healthcare services industry is facing many changes that pose new challenges to medical organizations big and small. In particular, the fast-evolving government regulations, Covid-19 Pandemic recovery, technological innovations, and patient expectations create a new environment in which running a medical practice isn’t just about treating patients anymore.

Looking into 2022 and beyond, here are ten major challenges faced by the healthcare industry and how to stay ahead:

10 Major Challenges Faced by Healthcare Services Industry

- Facing futuristic healthcare mechanization

- Telehealth

- The process of invoice and payment

- Constraint on pharmaceutical prices

- Growing costs of healthcare

- External market interference

- Shortages in healthcare staffing

- Healthcare Cybersecurity

- Price clarity

- Experience of patients

Internet of medical things is a concept where devices for advanced patient care increase the potential risks in this sector that in turn boosting the demand for technologically advanced cybersecurity measures thereby helping the market to grow.

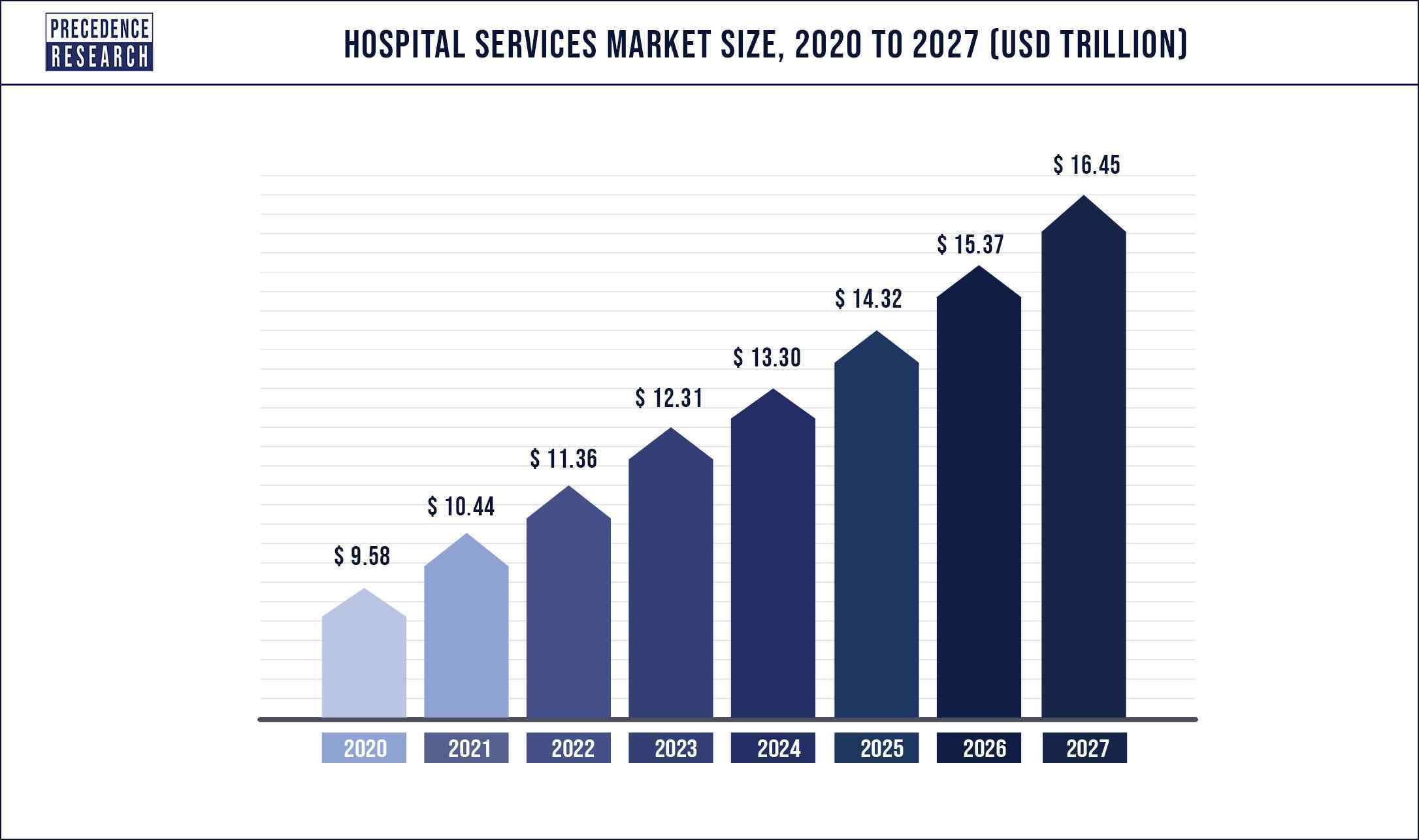

The hospital services market size is expected to reach USD 16.45 trillion by 2027 from USD 11.36 trillion in 2022, at a healthy CAGR of 8.2% every year.

The healthcare services market comprises of sales of healthcare related goods and services by entities (sole traders, organizations, and partnerships) that offer human healthcare services. This industry includes formations that provide services such as nursing care, dental services, medical & diagnostic laboratory services, residential substance abuse & mental health facilities, and other healthcare services.

Key Players & Strategies

The global hospital services market players face moderate competition owing to rapid changes in the medical services. In addition, medical advancement along with increased spending on the development of hospitals across regions has triggered the pace of competition in the overall market. Today, hospital service providers mainly focus towards offering differential service to their customers via technology and various management solutions. In addition, they also focus on merger & acquisition and geographic expansion strategies to establish their chain of service I various region or parts of the country.

Some of the key players operating in the market are Mayo clinic, HCA Healthcare, Cleveland clinic, Spire Healthcare Group plc, Ramsay Health Care, Ascension Health, Community Health Systems, Inc., Tenet Healthcare, and Fortis Healthcare among others.

Growth Factors

Key factors driving the global hospital services market are rise in prevalence of chronic diseases, aging population, rise in disposable income especially in the developing countries, and spike in the penetration of health insurance services. People with an age of 60 years and above are expected to contribute around 17% of the world’s population by 2030, high from the present population rate of 12%. Moreover, World Health Organization (WHO) has reported that around 70% of global deaths were due to non-communicable diseases in the year 2015.

The hospital infrastructure is still underdeveloped in several developing countries of Africa, the Asia Pacific, and Latin America. In India, the number of hospital beds is less than 1 per 1,000 populations that is quite below the Organization for Economic Co-operation and Development (OECD) average of more than 5 and the WHO average of around 2.7. This gap between supply and demand of hospital beds in developing and underdeveloped economies has led to significant growth in the private hospitals market. Apollo Hospitals Enterprise Ltd., India’s largest private hospital services provider, has expanded its capacity from 150 beds in 1983 to over 9,500 beds in 69 hospitals.

Key Highlights

- In 2019, North America emerged as a global leader accounting for a revenue share of nearly 50% in the global market due to rising cancer cases and cost of medical services

- The Asia Pacific exhibits attractive growth over the forecast period. Increasing investment for the developed of hospitals and rising number of private market players

- By service area, cancer and cardiovascular care were observed as the prominent revenue shareholder owing to aging population and cancer cases across the world

- Based on service type, inpatient service was the prominent segment in the global market because of hospitalization procedures that require long hospital stay

- Development in the communication technology anticipated to spur the growth of outpatient service over the analysis period

- In 2019, community hospitals were the largest revenue contributor and observed to grow at a steady pace during the coming years.

- Private hospitals seek lucrative growth over the forecast period due to the expansion of specialist capabilities and specifically cater to the critical patients

Regional Snapshots

North America is the most prominent revenue source compared to other region. The region accounted for around 50% of the total market value share in the year 2019. Ageing population, rising cases of cancer, and increasing cost of medical services in the region are the key factors that drive the overall market growth. Further, the region expected to retain its leading position over the forecast period. Technological advancement and increased spending on the development of hospitals across the region anticipated to propel the market growth. Introduction of smart hospitals that integrate artificial intelligence, analytics platform, and various connectivity solutions projected to upend the market trend in the healthcare service industry.

On the other side, the Asia Pacific expected to be the fastest growing region over the analysis period. The growth of the region is mainly attributed to the rising number of patients, increased number of surgeries, improves quality of hospital services, and rising number of private players in the developing nations such as China, India, and Korea. Further, the region encountered the highest spending on healthcare services in the recent past compared to other regions. Undeveloped healthcare facilities and treatment procedures in some of the parts of the Asia Pacific offer prominent opportunity for the players to enhance their market share in the region.

Download The Sample Pages Free of Cost to Better Understanding @ https://www.precedenceresearch.com/sample/1082